Healthcare costs are the leading cause of bankruptcy in America

Millions of Americans face debt and bankruptcy each year due to unexpected medical costs, even when they are employed and ensured.

- #1 use

of payday loans are to service medical bills

- 75%

of Americans struggle to pay a $500 medical bill

- 20%

of insured Americans can’t afford their medical bills

- $400B

in out-of-pocket expenses per year for Americans

Most Americans assume that if they’re employed and have health insurance, that means they don’t have to worry about medical expenses.

The weight of debt that falls on Americans each year is staggering – topping $400B in out-of-pocket medical expenses. Combined with the fact that 72% of millennials under 24 have less than $1,000 in savings and 31% have nothing saved at all, the risk of bankruptcy is alarming. In fact, $100B in medical debt never gets paid.

In 2016, the average American spent $10,345 on health-related bills. In 2007, that number was just under $8,000. Fifty years ago, the average was just $146 — which, when adjusted for inflation, means costs are 9x higher now. By 2023, that number is expected to be closer to $15,000 per year. This number is over twice the per capita average of other developed nations.

For many Americans who find themselves faced with this dilemma, the disconnect comes in the way insurance companies structure their coverage plans. Most don’t realize just how many medical procedures are not covered by their insurance plans, or fall under high premiums, copay, out-of-pocket, and out-of-network costs. The types of medical events that trigger these bills often aren’t exotic or rare procedures, either. The most common expenses fall in categories many assume are covered by their insurance plans – 52% for general doctor expenses; 44% for prescription drugs; 32% dental and vision each; and 27% for hospital-related bills. The highest average out-of-pocket costs are for orthopedics, plastic surgery, urology, and neurology, all ranging in the thousands or multiple thousands of dollars. The issue is heightened for those with high-deductible health plans, which now account for more than one-third of all American health plans. According to the National Center for Health Statistics, 43% of people under 65 who are insured by a private health insurance plan have an HDHP.

The deeper source of the problem lies in the cost of medical care in the U.S. On average, the most common medical procedures, like an appendectomy or normal delivery, cost 10-30% more in the United States than the rest of the world. In 2017 alone, out-of-pocket healthcare costs increased by 11%. On average, the increase in a given year is north of 5%. According to a recent study conducted by JPMorgan, roughly one in six families make an extraordinary medical payment in any given year, and are associated with 9% higher credit card debt a year later. Commonly, costs for prescription drugs cost up to 10x more in the U.S. then most developed countries. A day in a U.S. hospital costs roughly $5,220 – versus just $424 in Spain. C-section procedures cost twice as much in the U.S as they do in Australia, and the typical bypass surgery costs $54,000 more than the same procedure in the UK. The list goes on and on.

For the average American facing medical bills, credit cards are the first line of defense. Americans paid banks over $100 billion in credit-card interest and fees in 2017, up 11% from 2016, and up a staggering 35% from 2011. The compounding issue is that while credit is easily accessible, it is costly, with interest rates as high as 26%. The average American between 18-65 has $4,717 in credit card debt at any given time. 65% of credit card users carry a balance every month, meaning they don’t pay off their bill every month and therefore incur interest. Given that the average interest rate is 15%, a minimum payment of $189 on that $4,717 balance would take over 10 years to pay off and accrue $18,155 paid in interest alone.

For those with medical expenses that require deeper pockets of cash, they often fall prey to predatory lenders who charge massive amounts of interest. In fact, the number one usage of payday loans is to service medical debt. Even those with good credit can find themselves remortgaging their homes, taking out personal loans, or utilizing peer-to-peer lenders to raise money for healthcare costs. In fact, 30% of GoFundMe campaigns are used for medical bills.

The cost of healthcare is crushing most Americans, and there seems to be no end in sight to the growing crisis.

Enabling Americans to afford the cost of healthcare

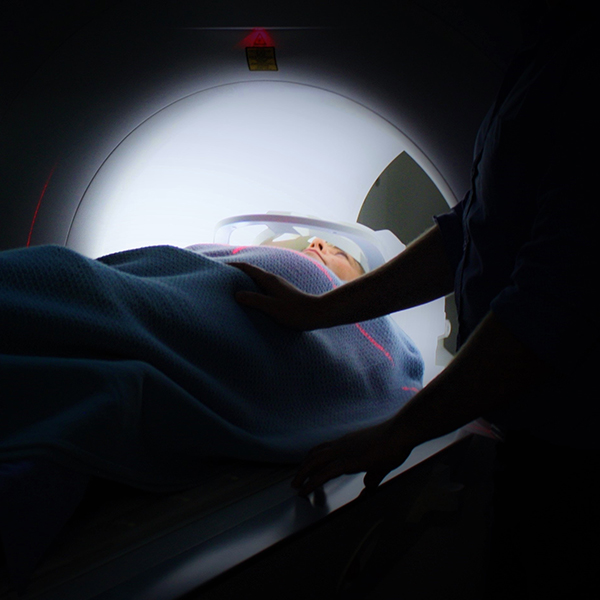

Most Americans simply can’t afford the cost of healthcare. Since many of these costs are unexpected, patients aren’t able to adequately anticipate and prepare for the costs, either. For those who find themselves facing staggering out-of-pocket and out-of-network bills, there are few viable options.

- 18%

of American adults visit the ER at least once per year

Zinsur is tackling one of the most destructive forces in America today by providing millions facing crippling medical debt with credit and loans to pay for healthcare costs.

Two years ago, Missa Guthrie-Mueller went through a personal experience that left her with large sums of medical-related bills, most of which her insurance company wouldn’t cover. With a background in finance, she was shocked that little-to-no financial products exist to help people struggling under the immense weight of hefty medical bills, often for procedures out of their control or ability to plan for. Determined to help millions of Americans in a similar crisis every year, the idea for Zinsur was birthed.

The Zinsur model is simple but powerful. Built as a lender exclusively for healthcare-related expenses, they partner with insurers and employers to bring low-cost financing options to consumers. Their goal is to protect consumer credit, free up household cash-flow, and provide a safe alternative to predatory lenders.

The Zinsur model is designed to solve several major pain points:

- Lower borrowing rates – helping Americans actually afford to get the medical treatment they need

- Reduced cash-flow pressure – enabling them to also keep up with their other bills like mortgage payments, car payments, and living expenses

- Credit score protection – proprietary underwriting specifically for healthcare loans creates a better-suited loan product

- Transparent payment & management – seamlessly integrated bills clear up confusion and reduce late payments through online loan management and digital bill pay

The Zinsur financial product is a 100% digital healthcare loan that is disbursed directly to the medical provider, so patients never see the money and providers get paid seamlessly and on time. It’s a clear win/win for both parties.

Zinsur also offers flexible payment options that open up more possibilities for patients dealing with long-term medical procedures or in need of special alternatives, including pre-emptive revolving credit, post-event loans, and payment plans. The solution not only helps save people from crippling debt, but also enables them to access otherwise unaffordable care, including specialists and necessary treatments not covered by most insurance plans.

Zinsur aims to be the future of healthcare finance, one that not only frees Americans from debt but ensures they can afford to live healthy, happy lives.